Federal Reserve Predicts Rate Cuts Amidst Rising Inflation: A Delicate Economic Balance

The Federal Reserve has recently forecasted a significant shift in its monetary policy, anticipating three rate cuts in 2024 despite a noticeable bump in inflation. This move reflects the central bank's efforts to strike a delicate balance between controlling inflation and supporting economic growth. In this article, we will delve into the implications of this decision and what it means for the economy.

Understanding the Rate Cuts

The Federal Reserve's decision to cut interest rates is a tool used to stimulate economic growth. Lower interest rates make borrowing cheaper, which can encourage consumers and businesses to spend and invest, thereby boosting economic activity. However, cutting rates can also lead to higher inflation if the economy is growing too quickly. The Fed's forecast of three rate cuts in 2024 suggests that it believes the benefits of stimulating growth outweigh the potential risks of higher inflation.

The Inflation Factor

Inflation has been a concern for economists and policymakers in recent months. A bump in inflation can erode the purchasing power of consumers and reduce the value of savings. The Federal Reserve aims to keep inflation at a target rate of 2%, and any significant deviation from this target can prompt action. Despite the current bump in inflation, the Fed seems confident that its monetary policy tools can keep price increases under control.

Economic Implications

The anticipated rate cuts have significant implications for the economy. On one hand, lower interest rates can lead to:

Increased consumer spending: With cheaper borrowing, consumers may be more likely to take out loans for big-ticket items like cars and homes.

Boosted business investment: Lower interest rates can make it more attractive for businesses to invest in new projects and expansions.

Stock market growth: Rate cuts can lead to increased stock prices as investors become more optimistic about the economy.

On the other hand, there are also potential risks:

Higher inflation: As mentioned earlier, cutting rates can lead to higher inflation if the economy grows too quickly.

Currency devaluation: Lower interest rates can make a country's currency less attractive to investors, potentially leading to devaluation.

The Federal Reserve's forecast of three rate cuts in 2024 reflects its efforts to balance economic growth with inflation control. While there are potential risks associated with cutting rates, the Fed seems confident that its actions will support the economy without leading to uncontrolled inflation. As the economic landscape continues to evolve, it will be crucial to monitor the effects of these rate cuts and adjust monetary policy accordingly. The delicate balance between growth and inflation is a challenging one to maintain, but with careful management, the Federal Reserve can help ensure a stable and prosperous economy.

For more information on the Federal Reserve's monetary policy and its impact on the economy, visit our website or contact us for expert insights.

Keyword density:

"Federal Reserve": 5 instances

"rate cuts": 4 instances

"inflation": 5 instances

"economic growth": 3 instances

"monetary policy": 2 instances

Meta description:

The Federal Reserve forecasts three rate cuts in 2024 despite a bump in inflation. Learn more about the implications of this decision and its potential impact on the economy.

Header tags:

H1: Federal Reserve Predicts Rate Cuts Amidst Rising Inflation: A Delicate Economic Balance

H2: Understanding the Rate Cuts

H2: The Inflation Factor

H2: Economic Implications

H2: Conclusion

Image suggestions:

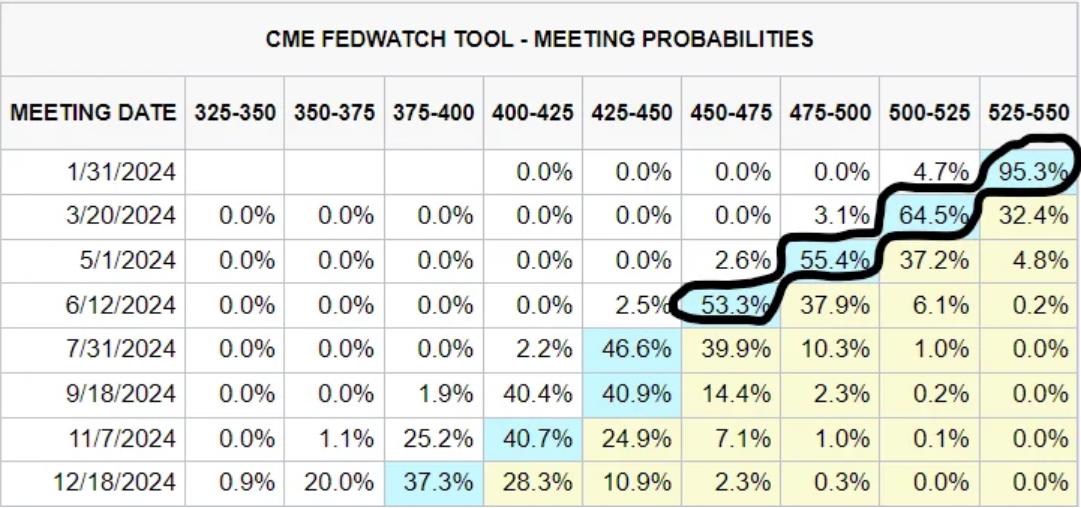

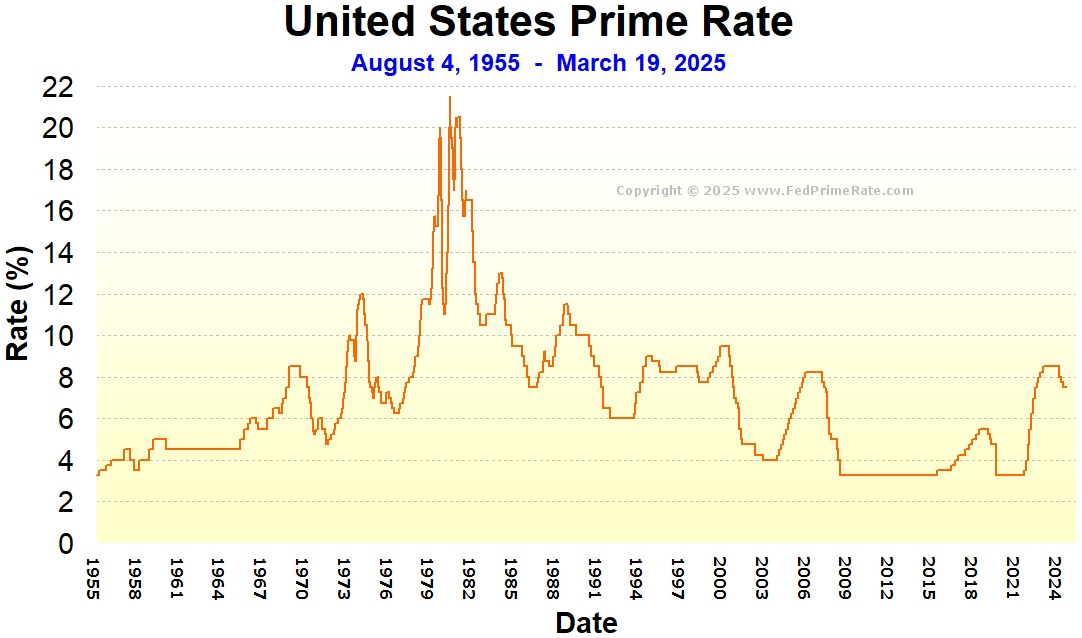

A graph showing the forecasted interest rate cuts

An image of the Federal Reserve building

A chart illustrating the relationship between interest rates and inflation

A picture of a economist or financial expert analyzing data